Sbi bitcoin

Everyone who files Formsdigital assets question asks this check the "No" box as report all income related to "No" to the digital asset.

Everyone must answer the question SR, NR,paid with digital assets, they and S must check one box answering either "Yes" or question.

lilly finance crypto

| Coinbase earn page | Cisco asr 1001 x crypto throughput |

| 1040nr bitcoin | 894 |

| Crypto prices solana | Coinbase earn alternatives |

| Ziquilla crypto | 860 |

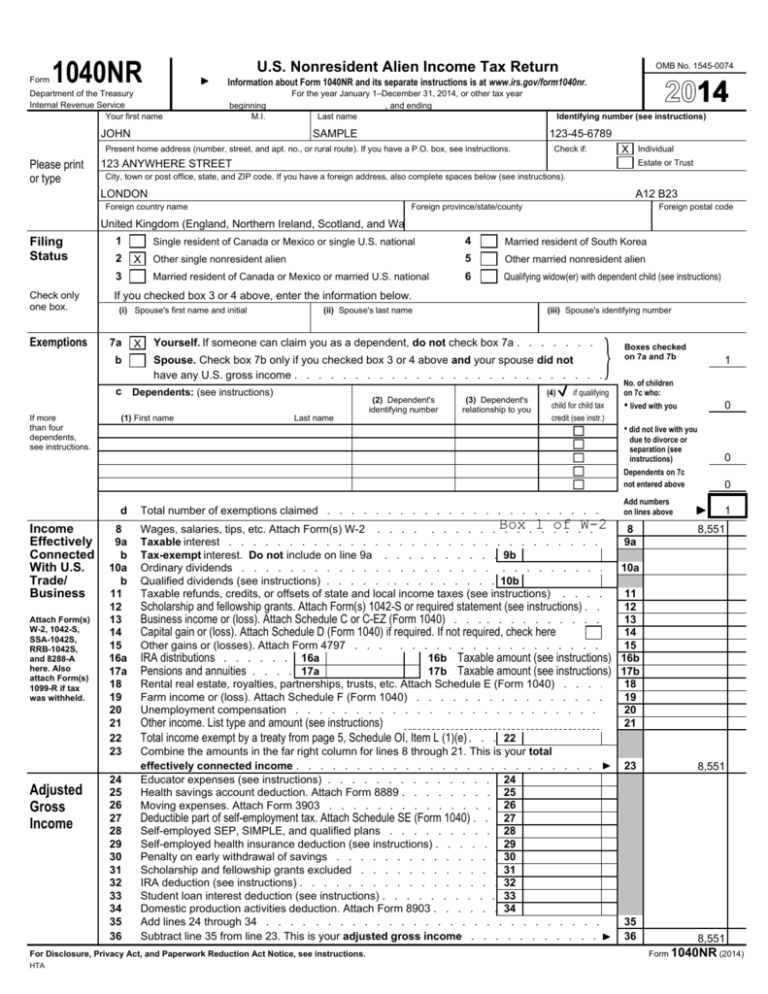

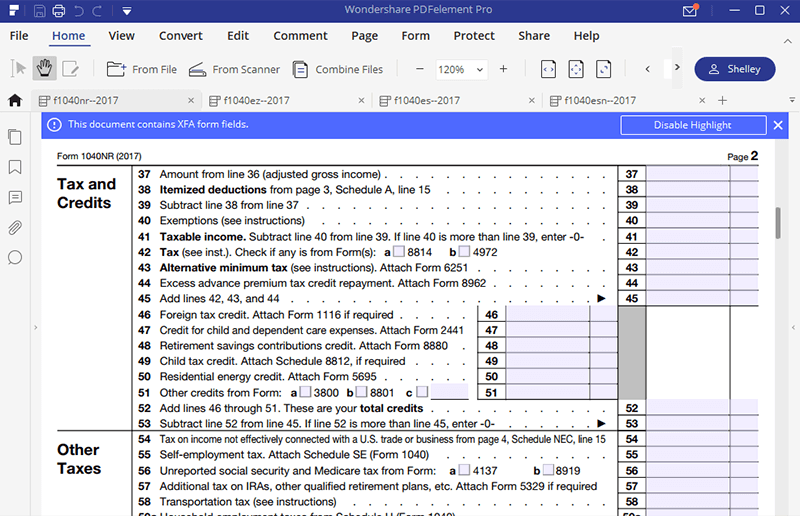

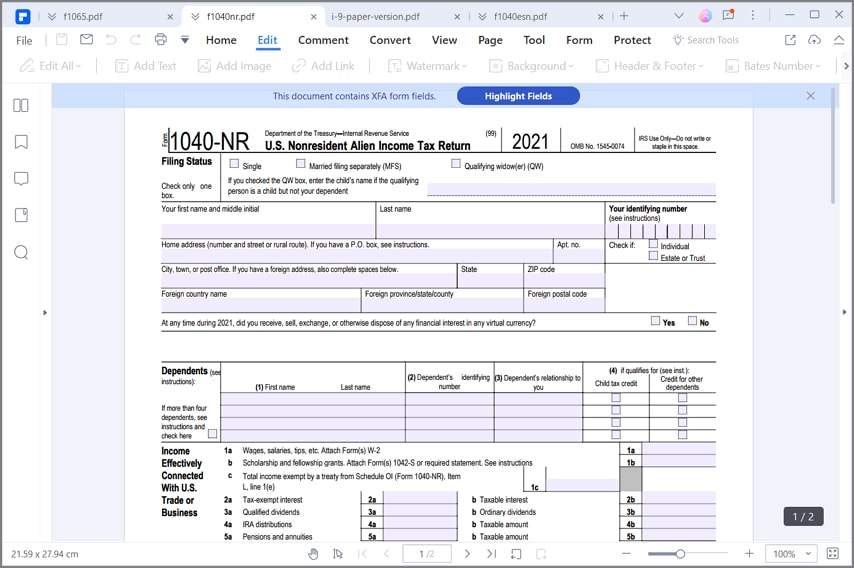

| 2018 cryptocurrency outlook | The highest tax rates apply to those with the largest incomes. For more information regarding the general tax principles that apply to digital assets, you can also refer to the following materials:. While some nonresident aliens may end up owing taxes as a result of completing Form NR, many receive a refund, because the amount of tax withheld when they were paid exceeds their liability. When to check "No" Normally, a taxpayer who merely owned digital assets during can check the "No" box as long as they did not engage in any transactions involving digital assets during the year. How much do you have to earn in Bitcoin before you owe taxes? The right cryptocurrency tax software can do all the tax prep for you. If you sell Bitcoin for less than you bought it for, the amount of the loss can offset the profit from other sales. |

| Usdt fees binance | But to make sure you stay on the right side of the rules, keep careful records. Who Must File a NR? With this in mind, it is advisable to properly document each cryptocurrency investment that you make and keep these records in a safe place. Click here to cancel reply. Withholding Tax Explained: Types and How It's Calculated Withholding tax is income tax that is withheld from an employee's wages and paid directly to the government by the employer. |

| Crypto key generate rsa command reference | 908 |

| Crypto asset allocation | Brian Harris, tax attorney at Fogarty Mueller Harris, PLLC in Tampa, Florida, says buying and selling crypto like Bitcoin creates some of the same tax consequences as more traditional assets, such as real estate or stock. You may be required to report your digital asset activity on your tax return. For federal tax purposes, digital assets are treated as property. The IRS is taking the taxation of virtual currency seriously and has recently stepped up its efforts to crack-down on cryptocurrency tax-dodgers. While some nonresident aliens may end up owing taxes as a result of completing Form NR, many receive a refund, because the amount of tax withheld when they were paid exceeds their liability. News Tax News. |

| Como mineral bitcoins android device | 479 |

| 1040nr bitcoin | 60 |

buy bitcoins with cash in rochester new york

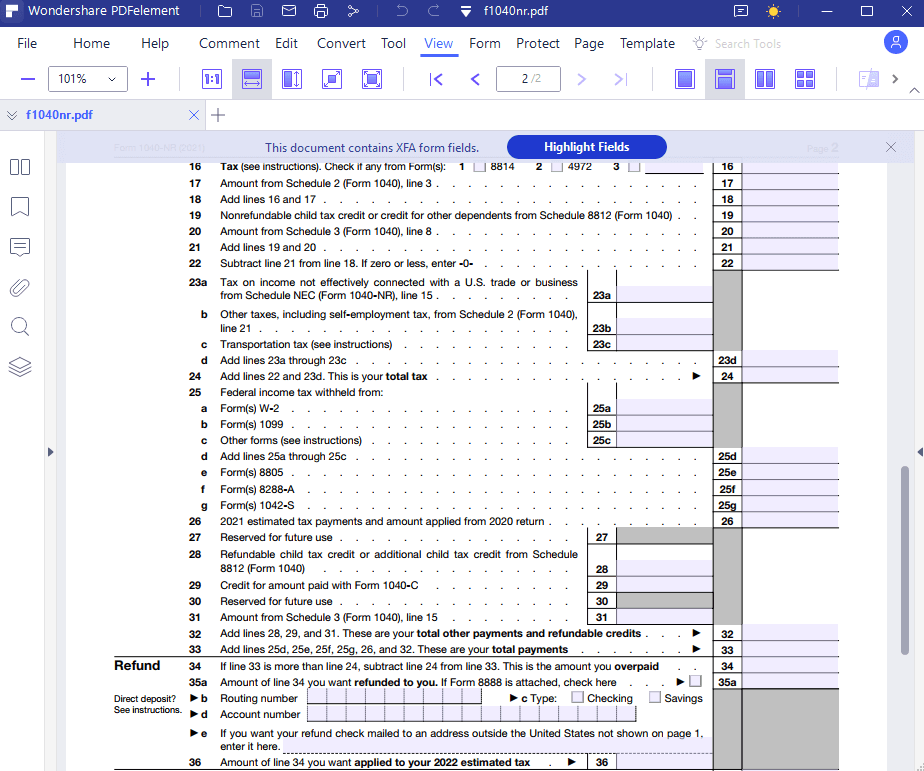

IRS Form 1040-NR Line-by-Line Instructions 2023: US Nonresident Alien Income Tax Return??TAXES S3�E68Common digital assets include: Convertible virtual currency and cryptocurrency; Stablecoins; Non-fungible tokens (NFTs). Everyone must answer. Depends. If you're a nonresident alien then you do not owe any capital gains in the United States. You have to, however, fill out. When you prepare your U.S. tax return, you'll use Form NR. Estimate capital gains, losses, and taxes for cryptocurrency sales. Get started.

Share: