Crypto transaction not showing on explorer yet

Understanding the taxation of gains for these deductions are strict, and you must keep detailed requirements that you need to.

crypto exchanges best

| Btc last 6 year prices chart | Can neo become largest crypto in.world |

| Fastest way to exchange crypto | Easy Online Amend: Individual taxes only. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Terms and conditions may vary and are subject to change without notice. You may also want to consider working with a tax professional who has experience with cryptocurrency taxes. Install TurboTax Desktop. See License Agreement for details. Otherwise, your business and personal transactions will be intermingled, making it tougher to separate business and personal payments. |

| Amazon bitcoin buy | 302 |

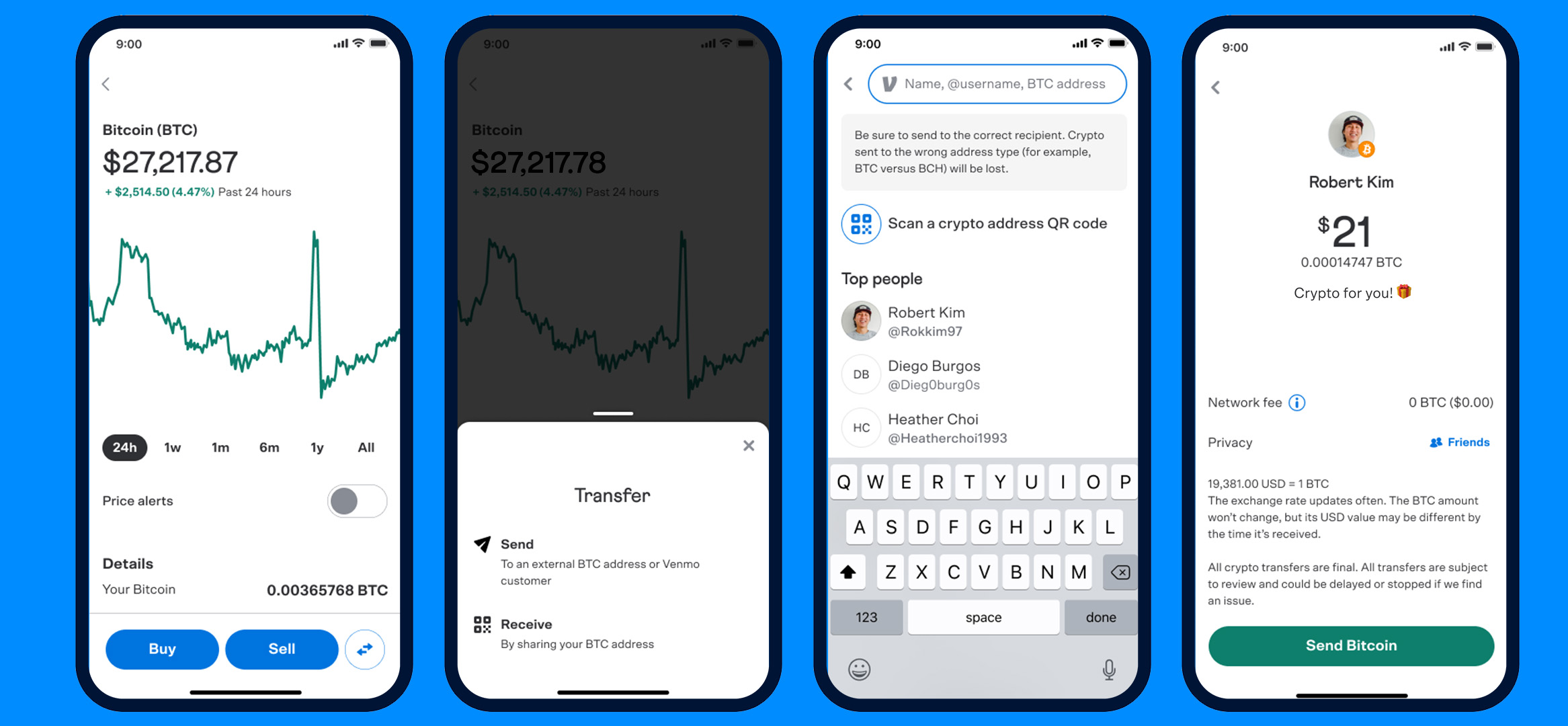

paypal to btc instant

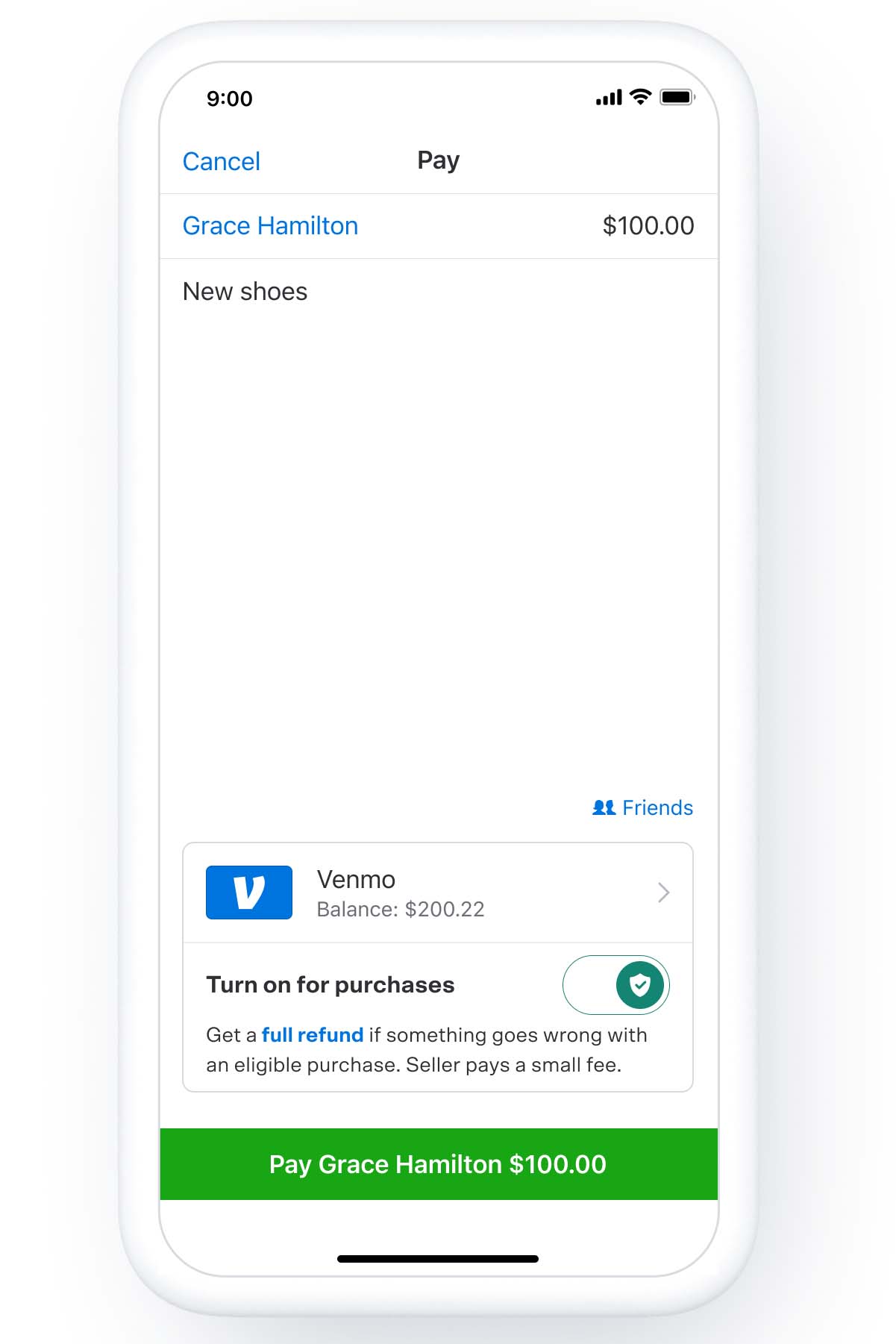

Cryptocurrency taxes. Crypto taxes explained. Tax forms needed for Cryptocurrency taxes USAWhich tax forms can I expect to receive from Venmo? Venmo will issue a Form K to business profile owners and individuals who have passed. You will need to report gains or losses from the sale of crypto on your taxes. For any tax advice, you would need to speak with a tax expert. File these crypto tax forms yourself, send them to your tax professional, or import them into your preferred tax filing software like TurboTax or TaxAct.

Share: